FHA Funding Fee

Related Terms: UFMIP, Upfront Mortgage Insurance Premium

Together, the Upfront Mortgage Insurance Premium (UFMIP) and the Mortgage Insurance Premium (MIP) make up the FHA funding fees. This is a necessary fee you must pay when entering a mortgage agreement which is backed by the FHA, in order to protect lenders from loss.

The UFMIP—which amounts to 2.25 percent of the mortgage—is paid when you get the loan. The MIP is added to your monthly payment and held in an escrow account. This insurance premium is based on the total amount of the mortgage, the length of the mortgage term, and the amount you can afford as down payment. The FHA allows borrowers to finance the funding fees, by including it in the mortgage.

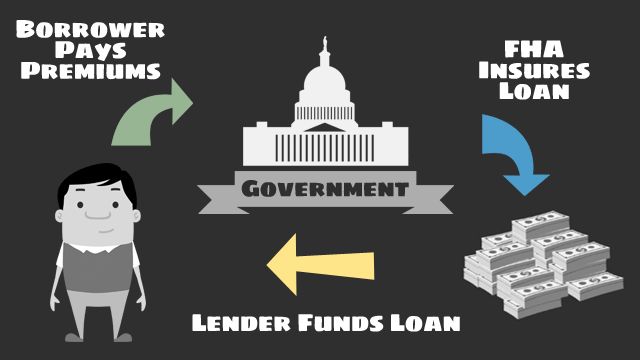

The FHA is not a mortgage lender, but a mortgage insurer. Borrowers are paying for such government-insured loans in the form of FHA funding fees. The funds collected are used to insure FHA-approved lenders. If a borrower were to default on his/her loan, the lenders can file a claim with the FHA and be reimbursed with money that comes from the funding fees.

The FHA is not a mortgage lender, but a mortgage insurer. Borrowers are paying for such government-insured loans in the form of FHA funding fees. The funds collected are used to insure FHA-approved lenders. If a borrower were to default on his/her loan, the lenders can file a claim with the FHA and be reimbursed with money that comes from the funding fees.

Do you know what's on your credit report?

Learn what your score means.