FHA Loan Tips for Improving Credit

Track Your Credit Score and Stay on Top of Problems

While FHA loans are known as a great service for people looking for help buying a house, applicants can make the process even easier if they take steps toward ensuring their credit history is in tip-top shape. The agency advises prospective homebuyers to approach FHA loans with their best possible credit history to eliminate any potential risk of not qualifying.

Whether you're looking for a loan to mortgage a new house or to refinance a house you already own, it makes the most sense open up all your options with an optimal credit rating. The FHA recommends having a satisfactory payment history of at least one year before applying for a loan.

Credit Tips for Your FHA Loan

Here are some tips to help you on your way:

- Take a Close Look at Your Credit Reports

You don't know what could be hurting your credit score unless you actually check. Get your credit reports from the three national credit bureaus--Experian, Equifax and TransUnion--at no cost and comb them over for anything suspicious or questionable. - Dispute Inaccuracies

If you find errors on your credit report, notify the reporting bureau in writing so you have a record. Provide any additional records or evidence you have to support your dispute. - Find Professional Help

The FHA recommends applicants with credit problems get help from a Consumer Credit Counseling program. A credit counselor can help you get back on track. - Bankruptcy / Foreclosure

If you've suffered from a bankruptcy or foreclosure in the past few years, you might still be able to qualify for an FHA loan. Develop a satisfactory payment history, re-establish good credit and meet the other FHA requirements.

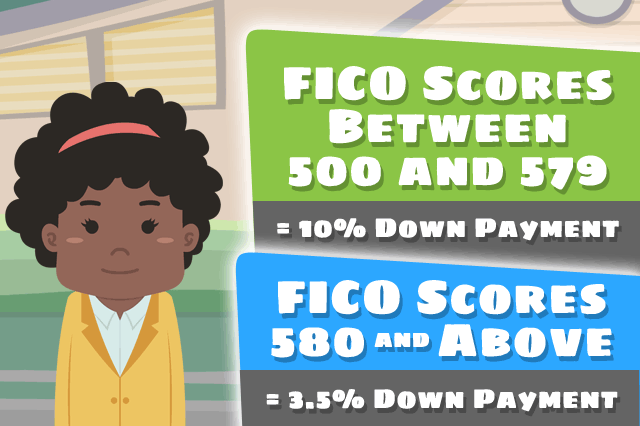

While your credit history is just one of the many factors that make up your eligibility for an FHA loan, it is no doubt one of the most important. Having a higher score not only helps you qualify, you can also benefit from the low 3.5 percent down payment on mortgage loans available to applicants with a FICO score over 580. FHA approved lenders don't take your credit history lightly, and neither should you.

Credit Scores for FHA Loans

SEE YOUR CREDIT SCORES From All 3 Bureaus

Do you know what's on your credit report?

Learn what your score means.

FHA Loan Articles and Mortgage News

July 26, 2024 - The FHA 203(k) rehabilitation mortgage and its refinance equivalent are tools for buying and renovating a home or remodeling an existing property. This loan can be used to buy a fixer-upper and finance the repairs needed to make the home livable and meet local building codes.

July 25, 2024 - The U.S. Department of Housing and Urban Development issued a proposed new rule in July 2024 that is intended to be a permanent policy regarding the sale of delinquent FHA single-family mortgage loans.

July 23, 2024 - When shopping for a home loan, you need to gather some basic information from multiple lenders to compare the costs, fees, terms, and conditions of the home loan you seek. During this process, you can verify information with each lender you choose.

July 22, 2024 - As we age, the significance of making sound financial decisions grows. Many choose to tap into their home equity in their retirement years, and two options are important to know: FHA reverse mortgages and FHA refinancing.

July 21, 2024 - FHA refinancing is worth considering if you want a government-backed loan insured by the Federal Housing Administration (FHA) that can refinance you out of a conventional adjustable rate mortgage or get you cash back at closing.