FHA Requirements

Debt-to-Income Ratio Guidelines

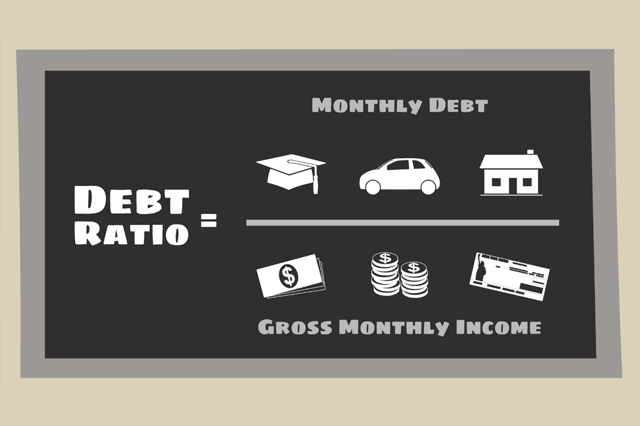

In order to prevent homebuyers from getting into a home they cannot afford, FHA requirements and guidelines have been set in place requiring borrowers and/or their spouse to qualify according to set debt to income ratios. These ratios are used to calculate whether or not the potential borrower is in a financial position that would allow them to meet the demands that are often included in owning a home.

The two ratios are as follows:

1) Mortgage Payment Expense to Effective Income

Add up the total mortgage payment (principal and interest, escrow deposits for taxes, hazard insurance, mortgage insurance premium, homeowners' dues, etc.). Then, take that amount and divide it by the gross monthly income. The maximum ratio to qualify is 31%.

See the following example:

2) Total Fixed Payment to Effective Income

Add up the total mortgage payment (principal and interest, escrow deposits for taxes, hazard insurance, mortgage insurance premium, homeowners' dues, etc.) and all recurring monthly revolving and installment debt (car loans, personal loans, student loans, credit cards, etc.). Then, take that amount and divide it by the gross monthly income. The maximum ratio to qualify is 43%.

See the following example:

Please note that the above indicators do not exclusively determine whether or not a candidate will qualify for an FHA loan. Other factors will be considered, including credit history and job stability.

FHA Loan Requirements

SEE YOUR CREDIT SCORES From All 3 Bureaus

Do you know what's on your credit report?

Learn what your score means.

FHA Loan Articles and Mortgage News

July 20, 2024 - When you close an FHA mortgage, you make your down payment and pay closing costs, accept the keys to the home, and prepare to move in. But what should you expect after moving into the new house?

July 19, 2024 - There are many FHA home loan programs, including construction loans and reverse mortgages, which have details some borrowers find confusing. However, assistance is available. HUD-approved housing counseling can greatly help.

July 17, 2024 - What fees and expenses can you expect from an FHA reverse mortgage, also known as an FHA home equity conversion mortgage (HECM)? There are a number of important costs to save for. We examine them in this article.

July 16, 2024 - There are many options to consider when planning your home loan. One good example? Some borrowers wonder if they should choose a 15-year FHA loan over a 30-year mortgage. Those who want to save as much money might consider the 15-year FHA loan, but there are other choices.

July 13, 2024 - According to HUD, the changes announced in early July 2024 modernize the program and enhance its usefulness for individuals and families seeking affordable financing for renovating or rehabilitating a single-family home when purchasing or refinancing it.