FHA Requirements

Debt-to-Income Ratio Guidelines

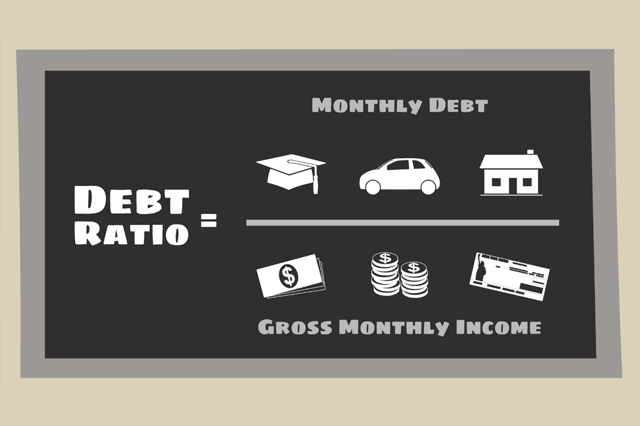

In order to prevent homebuyers from getting into a home they cannot afford, FHA requirements and guidelines have been set in place requiring borrowers and/or their spouse to qualify according to set debt to income ratios. These ratios are used to calculate whether or not the potential borrower is in a financial position that would allow them to meet the demands that are often included in owning a home.

The two ratios are as follows:

1) Mortgage Payment Expense to Effective Income

Add up the total mortgage payment (principal and interest, escrow deposits for taxes, hazard insurance, mortgage insurance premium, homeowners' dues, etc.). Then, take that amount and divide it by the gross monthly income. The maximum ratio to qualify is 31%.

See the following example:

2) Total Fixed Payment to Effective Income

Add up the total mortgage payment (principal and interest, escrow deposits for taxes, hazard insurance, mortgage insurance premium, homeowners' dues, etc.) and all recurring monthly revolving and installment debt (car loans, personal loans, student loans, credit cards, etc.). Then, take that amount and divide it by the gross monthly income. The maximum ratio to qualify is 43%.

See the following example:

Please note that the above indicators do not exclusively determine whether or not a candidate will qualify for an FHA loan. Other factors will be considered, including credit history and job stability.

FHA Loan Requirements

SEE YOUR CREDIT SCORES From All 3 Bureaus

Do you know what's on your credit report?

Learn what your score means.

FHA Loan Articles and Mortgage News

July 11, 2024 - Appraisals and home inspections are two separate but very important processes. For the purpose of this article, we focus on the mandatory FHA appraisal process the lender uses to establish the fair market value of the home.

July 9, 2024 - The FHA Home Equity Conversion Mortgage (HECM) loan program is an option for qualifying borrowers 62 or older. These loans require no monthly payment and feature a cash out option for the borrower.

July 8, 2024 - The FHA loan FICO score requirement is easy to understand. If your FICO scores fall between 500 and 579, FHA loan rules say you must pay 10% down, assuming lender standards allow loan approval for those scores.

July 6, 2024 - The FHA single-family home loan program includes both a fixed-interest rate option and an adjustable-rate home loan (ARM). In a housing market where mortgage rates are higher than they have been in many years, the adjustable-rate FHA loan is an option many consider.

July 3, 2024 - Borrowers sometimes assume things about home loan programs that aren’t true. For example, the USDA home loan option requires that the homes purchased with such loans must be in a rural area. But the USDA’s definition of rural is often quite different than you might think.