Managing Debt Ratios Before Applying for an FHA Mortgage

FHA Loan Approval Factors You Should Know

Your FICO score range is an important piece of data the lender uses to determine what kind of credit risk you are. But there are all kinds of risks associated with loaning money, and the lender will review your debts to find evidence of responsible credit use and reliable repayment history.

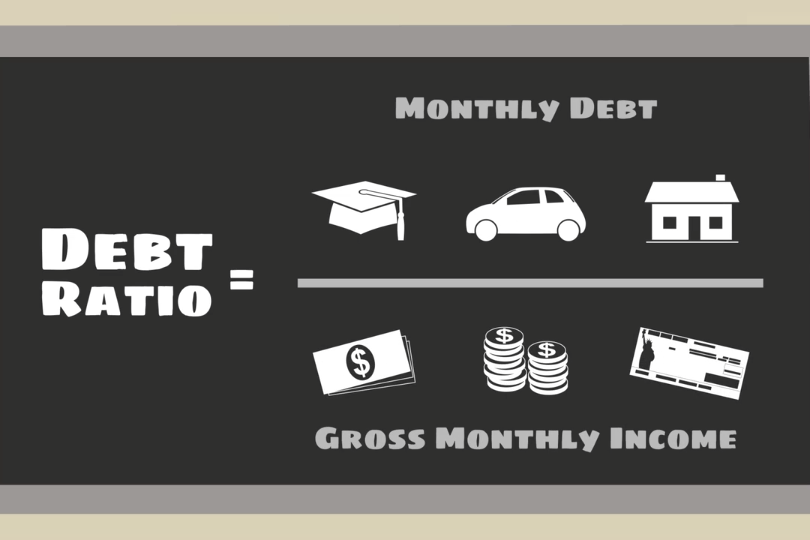

Your debt ratio can’t exceed a certain threshold. For FHA mortgages, you should typically come to the application process with a debt ratio of 43% or less, meaning that outgoing debt can take up no more than 43% of your monthly income.

Managing Your Debt Ratio for FHA Loan Approval

There are plenty of agencies offering advice on how to manage your debt ahead of a mortgage application. The Consumer Financial Protection Bureau (CFPB) offers a planning tool you can use to start working on your debts.

One of the most important early steps you can take to pare down your debt is to track your monthly spending habits. CFPB offers a monthly spending tracker sheet you can use to prioritize your spending each month and see where most of your money is going.

Some are quite surprised to learn how much they spend monthly on custom coffee, digital subscriptions, movie tickets, and restaurant outings. Seeing your money habits on paper can go a long way toward helping you get back on track with financial management or stay on track with your current plan.

What to Know About Debt Ratios

Some go too far when trying to manage debt. They pay down credit cards and cancel those cards, thinking that eliminating a line of credit might help them get closer to loan approval. But closing the accounts might not be the helpful move some think it is.

The age of a credit account is an important factor. Your lender may look more favorably at an account that is still open but has a very low minimum balance or none at all. But closing an old credit account doesn’t win you any additional consideration from the lender. Sometimes the opposite.

It’s also smart to avoid applying for new credit while trying to lower your debt ratio. Even if you want to consolidate a credit card or two, the closer you get to loan application time, the worse the idea applying for new credit becomes. It’s smart to avoid new credit applications for the year leading up to the loan.

------------------------------

RELATED VIDEOS:

Sometimes It Pays to Refinance

Don't Forget Your Closing Checklist

Your Home Loan is Called a Mortgage

Do you know what's on your credit report?

Learn what your score means.