FHA Home Loans by the Numbers

There are several numbers you’ll need to know ahead of time and a few that you won’t know until you are closer to committing to buying a specific property with an FHA mortgage. Here are some numbers to anticipate when planning and saving for your home loan.

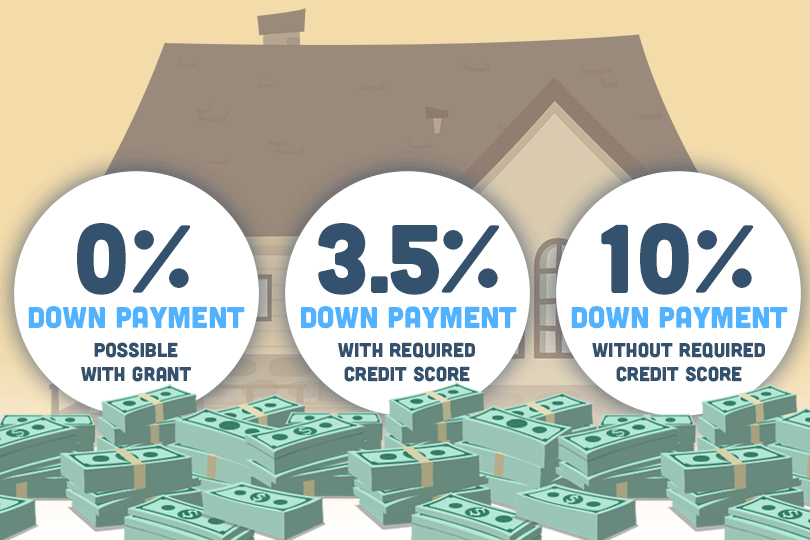

FHA Loans by the Numbers: Down Payments

FHA loan requirements say if you have FICO scores in the 500-579 range, you must make a 10% down payment. FHA loan rules for those with FICO scores at 580 or above a 3.5% down payment is required.

FHA loan down payments are calculated on the purchase price of the home, so there is no single dollar amount to cite as the amount you should save.

FHA Loans by the Numbers: Loan Terms

You can apply for a 15-year FHA mortgage which features higher monthly payments but a much faster payoff rate, or a 30-year FHA loan which has lower monthly payments than the 15-year version of the same loan.

FHA Loans by the Numbers: How Many Acres?

FHA loans require that the loan does not fund the purchase of “excess land”, which is described in HUD 4000.1 as “land that is not needed to serve or support“ the existing home. There is no specific acreage limit, and the appraiser may be required to make a value judgment depending on the circumstances.

FHA Loans by the Numbers: Mortgage Insurance

Your FHA loan mortgage insurance premium or MIP will last either the full term of the loan or 11 years, depending on how long the loan term is, the size of the mortgage, and other variables. HUD.gov states, “Lenders typically assess the annual MIP via 12 equal payments included in a borrower’s monthly mortgage payment.”

FHA Loans by the Numbers: Seller Concessions

Buyers and sellers can negotiate on who pays the closing costs on the transaction. The seller is allowed to contribute up to six percent of the price of the home toward closing costs as a way to sweeten the deal.

There is no set dollar amount here, but any seller contribution that exceeds six percent of the sale price of the home will result in a dollar-for-dollar reduction in the FHA loan amount.

When in doubt, always ask your loan officer to clarify the details of the loan transaction. Don’t sign any paperwork you don’t fully understand, and be sure you know how the above numbers affect your transaction based on your goals for the loan.

------------------------------

RELATED VIDEOS:

There's a Difference Between APR and Interest Rates

Choose Your Mortgage Lender Carefully

Getting Started With Your FHA Loan Application

Do you know what's on your credit report?

Learn what your score means.