Credit Requirements for FHA Loans

Good Credit History Makes it Easier to Qualify

FHA loans provide great assistance to many first-time homebuyers by offering mortgage loans with lower down payments. While this is a benefit for many people, recent changes in policy may have put the loans just out of reach for some would-be homeowners with questionable credit history.

Credit History and Score Requirements

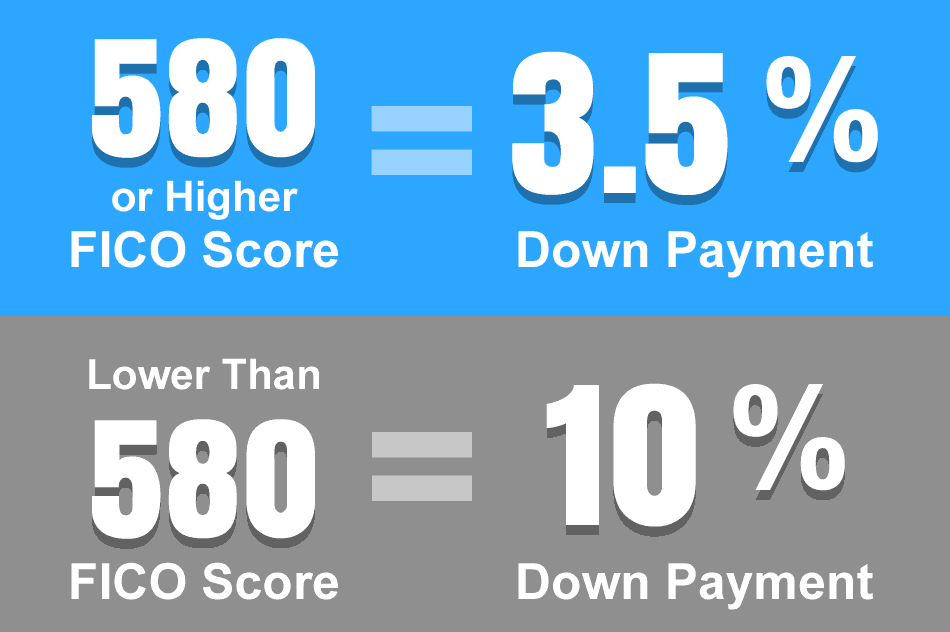

For those interested in applying for an FHA loan, applicants are now required to have a minimum FICO score of 580 to qualify for the low down payment advantage, which is currently at around 3.5 percent.

If your credit score is below 580, however, you aren't necessarily excluded from FHA loan eligibility. Applicants with lower credit scores will have to put down a 10 percent down payment if they want to qualify for a loan.

So if you're planning to buy a house, and your credit score doesn't meet the minimum, you should weigh the advantages and disadvantages of putting down a larger down payment or using those funds to try and improve your credit score first.

Benefits of an FHA Loan

The reason why FHA loans are so popular is because borrowers that use them are able to take advantage of benefits and protections unavailable with most traditional mortgage loans. Loans through the FHA are insured by the agency, so lenders are more lenient. Here are a few benefits you can enjoy with an FHA loan:

- Easier to Qualify

While most loans exclude applicants with questionable credit history and low credit scores, the FHA makes loans available with lower requirements so its easier for you to qualify. - Competitive Interest Rates

You've heard the horror stories of subprime borrowers who couldn't keep up with their mortgage interest rates. Well, FHA loans usually offer lower interest rates to help homeowners afford housing payments. - Lower Fees

In addition to lower interest rates, you can also enjoy lower costs on other fees like closing costs, mortgage insurance and others. - Bankruptcy / Foreclosure

Just because you've filed for bankruptcy or suffered a foreclosure in the past few years doesn't mean you're excluded from qualifying for an FHA loan. As long as you meet other requirements that satisfy the FHA, such as re-establishment of good credit, solid payment history, etc., you can still qualify. - No Credit

The FHA usually requires two lines of credit for qualifying applicants. If you don't have a sufficient credit history, you can try to qualify through a substitute form.

For many homebuyers, using an FHA loan can really make the difference between owning your dream house comfortably or turning it into a financial nightmare. The FHA provides a wealth of benefits for applicants that qualify, so make sure you're making full use of them.

Credit Scores for FHA Loans

SEE YOUR CREDIT SCORES From All 3 Bureaus

Do you know what's on your credit report?

Learn what your score means.

FHA Loan Articles and Mortgage News

July 11, 2024 - Appraisals and home inspections are two separate but very important processes. For the purpose of this article, we focus on the mandatory FHA appraisal process the lender uses to establish the fair market value of the home.

July 9, 2024 - The FHA Home Equity Conversion Mortgage (HECM) loan program is an option for qualifying borrowers 62 or older. These loans require no monthly payment and feature a cash out option for the borrower.

July 8, 2024 - The FHA loan FICO score requirement is easy to understand. If your FICO scores fall between 500 and 579, FHA loan rules say you must pay 10% down, assuming lender standards allow loan approval for those scores.

July 6, 2024 - The FHA single-family home loan program includes both a fixed-interest rate option and an adjustable-rate home loan (ARM). In a housing market where mortgage rates are higher than they have been in many years, the adjustable-rate FHA loan is an option many consider.

July 3, 2024 - Borrowers sometimes assume things about home loan programs that aren’t true. For example, the USDA home loan option requires that the homes purchased with such loans must be in a rural area. But the USDA’s definition of rural is often quite different than you might think.