FHA Loan FICO Score Tips

FHA Loan FICO Score Tip #1: Credit Score Improvement Takes Time

Some assume that working on your credit is something you can do in a few months’ time. But for best results, start working on reliable payments, lower credit card balances, and overall lower debt at least 12 months ahead of time.

Why? It takes time for your hard work to catch up to your credit reports. There’s no way to instantly update your credit reports.

FHA Loan FICO Score Tip #2: Don’t Cancel Your Old Cards, Just Pay Them Down

The oldest credit you have is valuable because FICO scores are influenced in part by the age of your accounts. Pay the accounts down, but don’t close them before a mortgage loan application.

Having the account may not carry the same liability (to your credit reports) as having an account too close to the maximum credit limit does.

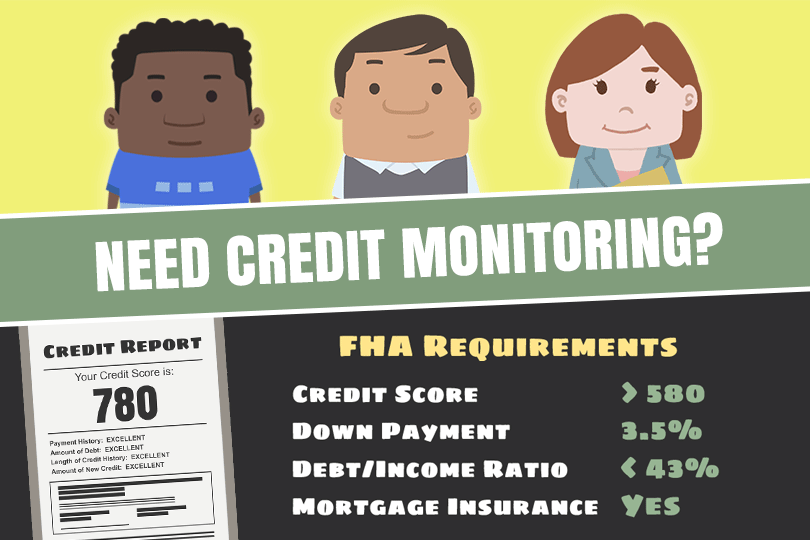

FHA Loan FICO Score Tip #3: Not All FHA Lenders Have The Same FICO Score Requirements

FHA loan minimum standards are indeed the same no matter where you apply. But it is NOT true that lender standards are identical. Shop around for a lender, there may be one more willing to work with your circumstances than others.

FHA Loan FICO Score Tip #4: If You Challenge Your Credit Reports, Expect Delays

One reason we urge people to start working on credit issues early? If you find errors or other problems in your report that need to be fixed, it will take longer than you expect to do so. It’s not a two-week process, it can take months to sort out. Start early.

FHA Loan FICO Score Tip #5: Set Up Automatic Payments

The 12 months leading up to your FHA loan application are crucial from a credit report perspective. Consider putting all your financial obligations (or as many as possible) on an automatic payment system using ACH transfers or other means to make sure you make all of the payments on your credit accounts.

Missed payments in the 12 months leading up to the loan can really hurt your loan approval chances, depending on circumstances and other variables. It’s always smart to add an extra layer of protection to avoid missing even one payment.

------------------------------

RELATED VIDEOS:

Learn How to Meet FHA Requirements

Understanding APR

Your Proof of Ownership Is the Property Title

Do you know what's on your credit report?

Learn what your score means.