How to Prepare for a Home Loan

- Choosing a lender

- Choosing a home

- Saving for your down payment

- Working on your credit

In housing markets where interest rates are rising, comparing lender options is more important. The rates you are offered at one financial institution may look different than the rates you are offered elsewhere.

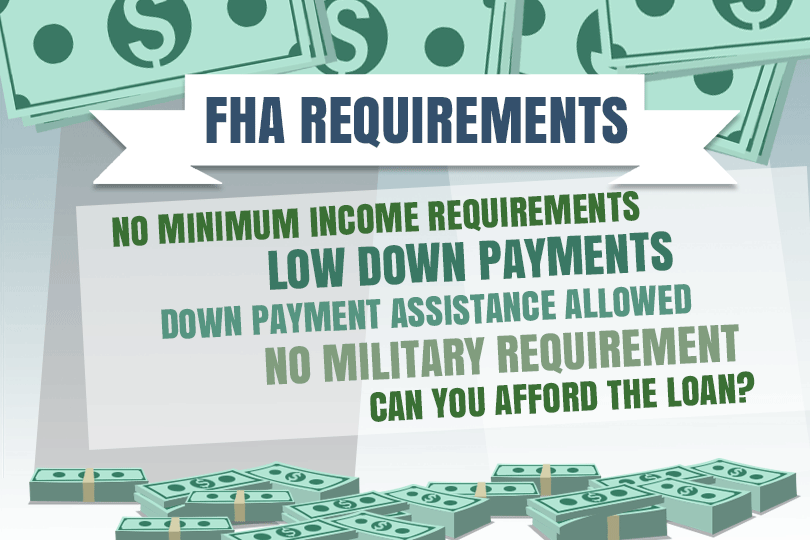

And it isn’t just the rates; no two lenders may offer the exact same terms and conditions. You may find a lender offers some FHA loan types, but not others.

Do you need a manufactured home loan or an FHA condo loan? Make sure you know for sure whether the lenders you’re considering offer these types of mortgages. Not all do, and it’s a mistake to assume that the same type of loan program used to buy a suburban home is also an option for condo loans or other property types.

Choosing a Home

It isn’t just the nature of the property--condo, suburban home, farm residence, manufactured home, etc.--it’s also about the size and sometimes even the location.

Did you know that FHA loan rules include instructions to the lender about whether a home is eligible in a known natural disaster zone? These are important considerations and you should be thinking about them as early in the planning stages as possible.

Saving for Your Down Payment

FHA loans for typical purchases always require a down payment. How much you need to save for the down payment depends on how much you want to borrow or are approved to borrow. The lowest possible FHA down payment is 3.5%; a home that costs 250,000 may require more than $8 thousand down. How long will it take you to save your down payment knowing it could be as much as that, depending on circumstances? Giving yourself more time to save, not less, is key.

Working on Your Credit

Simply put, if you don’t know the contents of your credit report and your FICO scores, you aren’t ready to apply for a mortgage. You should review any credit report errors and outdated information as early as possible in the planning stages, and monitor your reports on a regular basis until your loan application has been submitted.

Making on time payments, lowering your credit card balances, and reducing the overall amount of debt you carry are important factors in getting ready for your mortgage.

------------------------------

RELATED VIDEOS:

Learn How to Meet FHA Requirements

A Few Tips About Your Fixed Rate Mortgage

Your Proof of Ownership Is the Property Title

Do you know what's on your credit report?

Learn what your score means.