Things to Consider Ahead of Your FHA Home Loan Application

Checking Your Credit

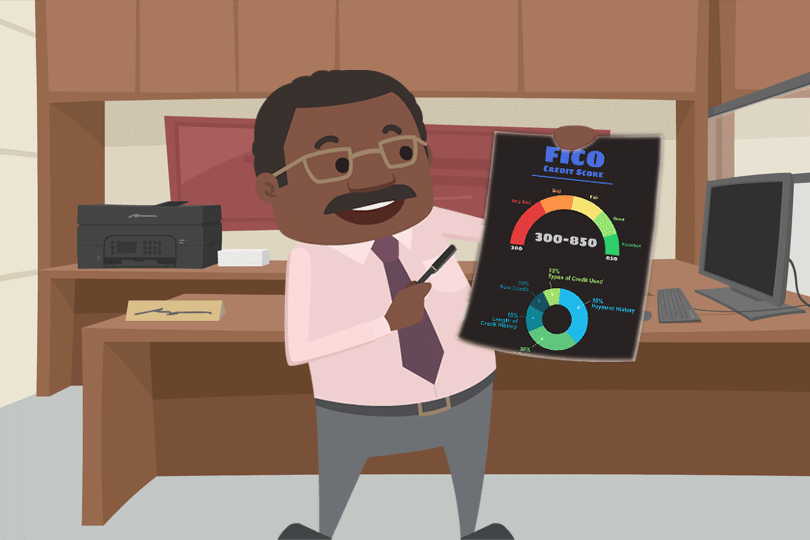

“Check your credit reports” is advice you will read frequently when you research mortgage loans. But what should you consider when examining your credit aside from the FICO scores themselves? Your scores count, but so does your credit utilization. How do you use your credit cards? That’s an important factor, but one that doesn’t get as many paragraphs in the mortgage loan advice articles as FICO scores themselves.

What does it mean to have good credit utilization?

That phrase means that if you carry balances below a certain percentage of your credit limit, you are using your credit accounts well (in the eyes of a lender). It’s a good idea to set an initial goal of getting your account balances below 50% of your credit limit. Ideal credit utilization is 30% of your credit limit or less on all accounts, but that may seem like a tough goal to reach initially.

Under 50% of your credit limit is a good goal to start with, and you’ll want to lower your balances on as many accounts with a credit limit as possible to reap the benefits.

Check Your FICO Scores and Compare FHA Lenders

Review your FICO scores in your credit reports from TransUnion, Experian, and Equifax. Then you can compare them to the FICO score requirements for FHA loans with multiple participating lenders. Do this early, since the goal is to determine what interest rates on the mortgage you may qualify for. Do your scores need improving to get a better rate?

You might be a few FICO score points away from a better mortgage rate, or you may have to work a bit longer to improve your credit scores and qualify for the lower rates. If you begin as early as possible, you get more time to improve your credit through on-time payments and lower debt ratios.

Give Yourself Extra Time

Reviewing your credit could mean discovering problems such as errors in your reports or entries for credit accounts you don’t remember opening. In such cases, fixing these issues may take longer than you think.

Ask any participating FHA lender for advice on this issue and you’ll likely get the same advice--working on your credit early is smart but you may need to take extra time to ensure discrepancies in the report are fully resolved before you apply for a new line of credit.

------------------------------

RELATED VIDEOS:

Homebuyers Benefit From the Work Done by Fannie Mae

HUD 4000.1 is Sometimes Called the FHA Handbook

Credit History Is Presented as Your FICO Score

Do you know what's on your credit report?

Learn what your score means.