Choose Your Mortgage Options Carefully

The good news about FHA loans is that you don’t have to be a first-time homebuyer to use one--some people still mistakenly believe that you DO have to be a first-time buyer to use FHA.

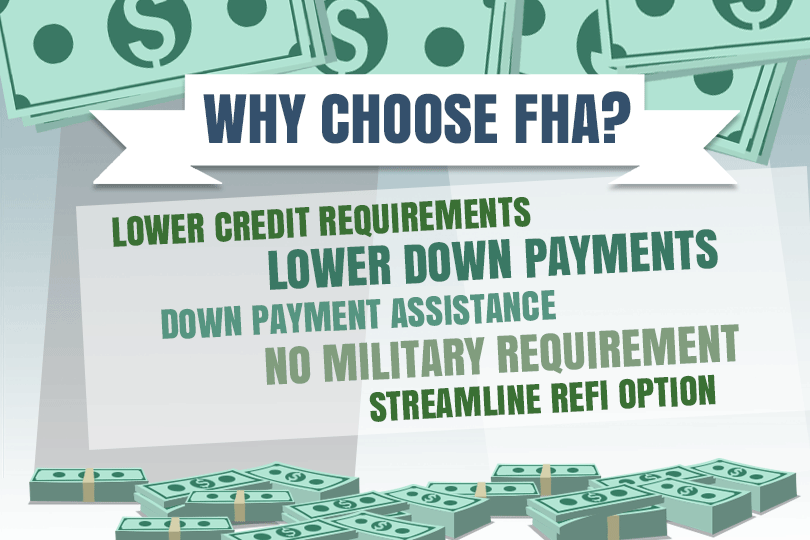

There are many reasons why someone chooses the loan product they wind up using to buy a first home or an upgraded one. A lot depends on your financial needs and goals--they can make some loan options a better choice depending on what you want from your mortgage.

Set Goals and Make Plans for Your FHA Mortgage

What does it mean to have goals for your home loan? Simply put, you should try to decide as early as possible what your priorities are, financially speaking, for the loan. Do you want to save as much as you can on the total cost of your mortgage over the full term of the loan?

If so, the choices you make will be informed by that--you wouldn’t want to pay discount points on a home you were thinking might be sold again in a few years, and if you are planning to keep the home long term instead it pays to get a fixed-rate mortgage rather than an adjustable-rate one.

Your Future Plans May Affect Today’s Decisions

Why? In both cases, the time you spend owning the home plays an important part in whether the discount points or the adjustable-rate loan make sense. An adjustable-rate mortgage can be an effective way to keep your early payments lower. At least until the introductory rate (also known as a “teaser” rate) period expires.

Selling or refinancing before that happens is a way to avoid future rate increases--do you plan to sell early? If so an adjustable-rate loan might be for you.

The same with discount points but in reverse--if you buy points but later sell the home, was the money you paid for those points worth the trouble? Staying in the house long-term makes discount points a better move if your goal is to save money over the lifetime of the loan.

Expect the Unexpected

Even the best-laid plans can be interrupted by problems--the era of COVID-19 has taught us plenty about what can happen while you are making other plans. It’s best to anticipate that a home may cost more upfront than you realize, that you may experience some financial issues along the way, etc.

Planning for these makes a huge difference--saving a little extra, having realistic expectations of what you can afford to pay each month on a mortgage plus insurance and ultilties, etc.

Always try to think of owning a home like a game of chess--try to stay a move or two ahead to anticipate future issues that may affect your ability to own and maintain the home.

------------------------------

RELATED VIDEOS:

Consider the Benefits and Risks of a Joint Loan

Borrowers Should Know About the Origination Fee

Everyone Needs to Pay Their Property Tax

Do you know what's on your credit report?

Learn what your score means.