Which Matters More, FICO Score or Credit Report?

When a home loan application is submitted, the participating lender is required to review a number of financials including the borrower’s employment and employment history, income and the history of that income, plus any other available credit information.

This is done to determine that you are a good credit risk and that the lender is able to justify approving your loan.

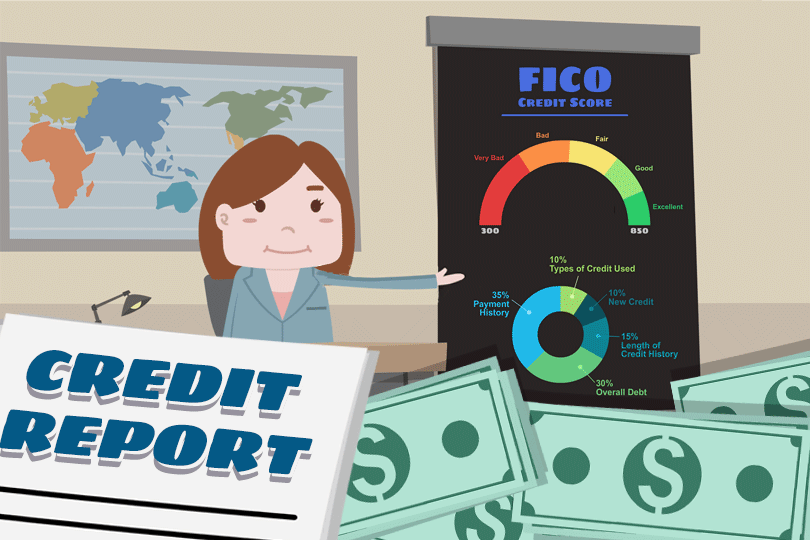

It’s easy to assume your loan officer might only be interested in your FICO scores, which are assigned to you based on the information in your credit report. What information? Basically how you utilize your credit--patterns, payment history and consistency, etc.

FICO scores ARE important but the scores themselves cannot tell the entire story--factors that go into determining your credit score as those factors are of interest to your lender because they tell the lender what to expect from you in terms of your own reliability with credit.

TransUnion, a major credit reporting agency, reminds borrowers on its official site that FICO scores may be determined by using the information found in your credit report. Your credit score change as often as the information in your report changes, according to the TransUnion official site. And yes, you will have multiple credit scores. This is normal.

What are the factors that your lender will look at with respect to your FICO score? There’s a list:

- Payment history

- Amount of credit owed

- Credit utilization

- Length of time credit has been used

- New credit accounts

- Credit diversity

Notice that we used a numbered list. That’s because payment history, at the top of the list as Number One, is the most significant factor. That said, don’t neglect any area of the list if you need to work on your credit history and FICO scores.

Payment history is number one on the list for a simple reason. Late or missed payments showing up in your report within the last 12 months are basically Kryptonite for your home loan, you will want to submit your home loan application once you have a solid 12 months of on-time payments with no late or missed payments.

Paying for credit monitoring once you have committed to your home loan is also a very good idea. You work hard to improve your credit scores and keep your payment history clean. Monitor your credit during the planning and saving stages of your mortgage loan to make sure you don’t get errors or evidence of identity theft in your report along the way.

------------------------------

RELATED VIDEOS:

Understand the Reasons for Private Mortgage Insurance

Carefully Read Your Closing Disclosure

Buying a Home With a Co-Borrower

Do you know what's on your credit report?

Learn what your score means.