Why Should I Pay for Credit Monitoring?

One of the big three credit reporting agencies, Experian, advertises these services with a tagline stating, “Your credit report and FICO Score. All free.” So why should a consumer choose to PAY for credit monitoring instead of taking advantage of what the credit reporting agencies and others choose to offer you for free?

Sometimes You Get What You Pay For

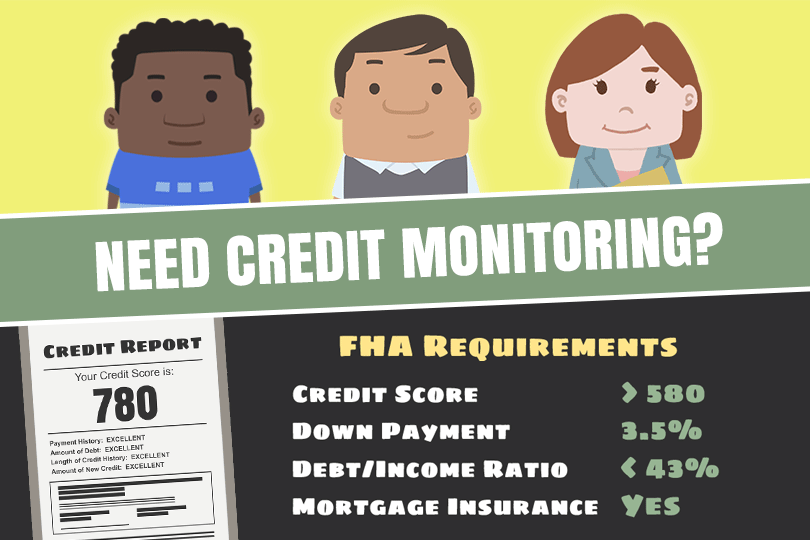

The simple answer is that free services likely don’t go far enough to truly help a potential home loan applicant who needs to make absolutely sure their credit score and credit report are ready for a lender to review with no indicators of errors, identity theft, etc.

Reviewing your credit report once before a loan application is not enough--identity thieves can attempt to open new credit accounts in your name at any time--you want real-time monitoring of your credit ahead of the most important investment you can make as an ordinary consumer.

The same way you don’t skimp on important issues like termite inspections, lead paint abatement, and overall health and safety issues associated with buying a new home, you won’t want to skimp on the health and safety of your personal finances, either.

Credit Monitoring Should Be Part of a Bigger Strategy

Paying for credit monitoring is not a fail-safe guaranteeing you a perfect credit report and home loan approval--what you do as a consumer with your credit in the meantime is just as important as making sure your credit report is free of errors and identity theft issues. That means your use of credit monitoring should be part of a larger strategy to make you a more reliable credit risk.

And what should that strategy include? Avoiding new lines of credit in the year leading up to your home loan application for a start.

On-Time Payments Count

You will also need a minimum of 12 months of on-time payments for ALL financial obligations--don’t bother applying for a major line of credit if you have late or missed payments in the last 12 months. Instead, wait out the time you’ll need to go to the lender with a full year of on-time payments.

Doing these things will get a consumer much closer to home loan approval. It’s an approach that requires discipline and long-term thinking. It’s also worth it in the end. The extra effort you put in today is the potential loan approval notice you’ll get tomorrow.

------------------------------

RELATED VIDEOS:

Obama Mortgage Is the Home Affordable Program

Principal Payments and Your FHA Loan

Living in a Single Family Home

Do you know what's on your credit report?

Learn what your score means.