Does Checking My Own Credit Hurt My Credit Score?

Not All Credit Inquiries Are the Same

The Consumer Financial Protection Bureau (CFPB) is a government agency that offers information and resources to consumers in a variety of areas related to credit including mortgages, credit cards, auto loans, and more.

The CFPB official site reminds consumers that the kind of credit check you do on yourself is NOT the same as the credit inquiry your lender will submit.

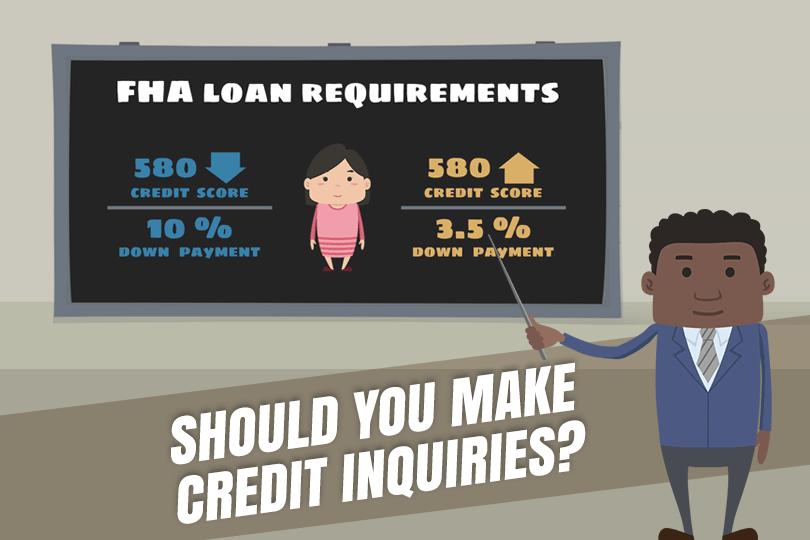

The lender’s credit check is known as a hard inquiry, and that DOES slightly lower your credit score as a result. Some borrowers feel they are already on thin ice creditwise and are afraid to do any damage to their credit that might hurt chances at loan approval.

Check Your Credit Scores Today

But the consumer can check her own credit score without damaging it. CFPB says, “When you check your own credit — whether you're getting a credit report or a credit score — it's handled differently by the credit reporting agencies and does not affect your credit score. If you are applying for a mortgage and haven't already checked your credit report for errors, do so now.”

A lot of borrowers check their own credit reports before starting a credit monitoring subscription--which is a very good idea to do--to get an idea of what’s in the report and what may need attention ahead of credit monitoring and a home loan application. You should definitely know the contents of your credit report long before applying for a loan of any kind.

What to Do if You Find Problems in Your Credit Report

When you look at your credit report while preparing for a new loan, you should check the report as early as possible and give yourself plenty of time to report any problems you find in your credit file. Do you have old information that needs to fall off your report but for some reason has not?

Do you have credit data from somebody else with the same name or a similar name as yours? Believe it or not, that’s more common than you might suspect. Do you see credit report entries on credit accounts you don’t recognize?

All of these problems must be reported to the credit reporting agency and it takes time not only to clean up your report but ALSO for the newly fixed credit report to go into circulation. Don’t expect these issues to be resolved in days or weeks, it takes months to correct and you should NOT apply for a loan while such issues are pending resolution.

------------------------------

RELATED VIDEOS:

Here's the Scoop on Conventional Loans

When Do You Need a Cosigner?

Analyzing Your Debt Ratio

Do you know what's on your credit report?

Learn what your score means.