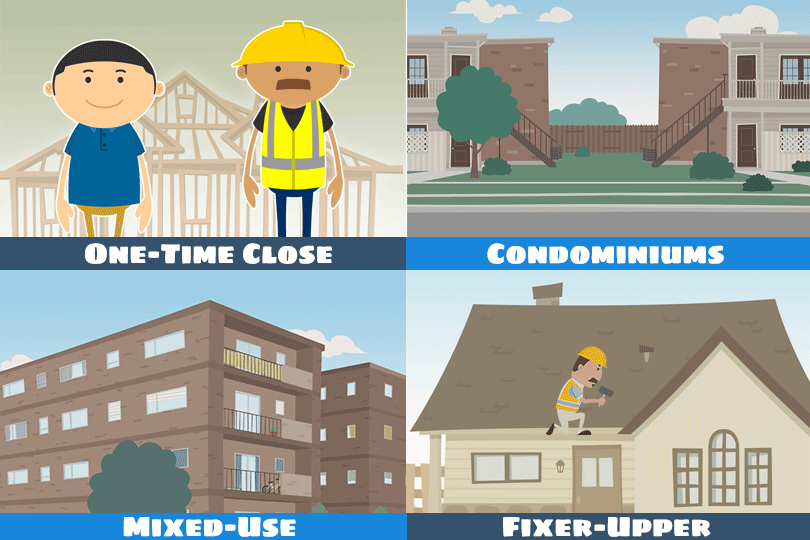

What Kinds of Homes Qualify for an FHA Loan?

FHA One-Time Close Construction Loans

How would you like to have a house built from the ground up instead of searching for just the right property as an existing construction property? This is possible, even for first-time home buyers, with an FHA One-Time Close construction loan.

This type of home loan may require higher FICO scores (depending on the lender) and may be limited (again, based on lender standards) to single-unit residences. One-Time Close loans require the use of architectural plans, contractors, and other third parties; you will need to plan and budget for these expenses along with the typical home loan costs such as appraisal fees, inspections, etc.

FHA Fixer-Upper Loans

You can ask your participating FHA lender about applying for an FHA 203(k) rehab loan which is also available as a refinance loan. FHA 203(k) mortgages allow you to buy and rehab, or refinance and rehab, a home you want to use or are currently using as your primary residence.

These loans have no FHA-required FICO score guideline differences than for other loans-that means the same basic financial qualifying criteria will apply for these loans as for new purchase loans for existing construction. That does not mean your lender won’t have additional standards, but that’s one reason why it’s good to shop around for a lender; find one who can work with your financial needs and goals.

FHA Condo Loans

FHA condo loans have some unique requirements, but you can definitely purchase a condo unit in an approved condominium project. Because condo projects will have a Condo Owner’s Association or a similar organization, you will need to read their bylaws and covenants carefully to determine whether that condo is right for you.

FHA Mortgages for Mixed-Use Property

Some homes are zoned residential-only, while others are zoned for mixed use. If the property you want to purchase with an FHA mortgage is primarily residential, and will be used as your primary residence, you may be able to purchase a mixed-use property with an FHA mortgage.

You cannot buy an investment property (one you don’t intend to live in) with an FHA Single-Family Home Loan, but a mixed use property with at least 51% of the space dedicated to the residence may qualify if it meets FHA and lender standards.

------------------------------

RELATED VIDEOS:

Get to Know HUD

Using an FHA Loan Calculator

Living in a Single Family Home

Do you know what's on your credit report?

Learn what your score means.