FHA Home Loan Credit Check Rules You Should Know

What follows does NOT address individual lender standards-we are discussing FHA loan rules only.

These rules could be considered minimum standards that a lender might build upon but in any case you will need to discuss your circumstances with a participating lender to see what additional requirements may apply.

FHA loan rules for credit checks are found in HUD 4000.1, the FHA Single Family Home Loan Handbook. There are sections in this rulebook that address non-traditional credit, thin credit, etc.

One section begins by explaining, “The underwriter must determine the creditworthiness of the Borrower, which includes analyzing the Borrower’s overall pattern of credit behavior and the credit report.”

But where thin credit, lack of credit, non-traditional credit and related situations are concerned, FHA loan rules state clearly, “The lack of traditional credit history or the Borrower’s decision to not use credit may not be used as the sole basis for rejecting the mortgage application.”

But in these cases you may find more strict standards for approving such borrowers. The very next line in the section containing the quote above includes this:

“Compensating factors cannot be used to compensate for any derogatory credit.” That is in direct contrast to FHA loan standards for borrowers with traditional credit profiles. In those cases, FHA loan rules permit the lender to approve borrowers with lower credit scores if they have compensating factors that can work in their favor.

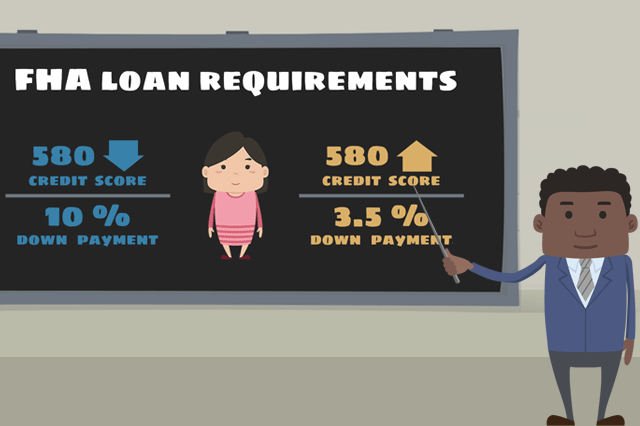

Those compensating factors would include a bigger down payment in many cases. Borrowers with lower FICO scores should anticipate that and save up accordingly.

Why do FHA loan rules allow thin credit and non-traditional credit? It reflects an overall philosophy of the FHA, which has a section of the home loan rules that instructs the lender:

“The underwriter must review each Mortgage as a separate and unique transaction, recognizing that there may be multiple factors that demonstrate a Borrower’s ability and willingness to make timely Mortgage Payments...”

Your participating FHA lender must. “evaluate the totality of the Borrower’s circumstances and the impact of layering risks on the probability that a Borrower will be able to repay the mortgage obligation according to the terms of the Mortgage.” That is important to remember when you are trying to save and plan for an FHA mortgage. If you have issues that need addressing with finances and credit, give yourself extra time to resolve them BEFORE filling out home loan application paperwork.

------------------------------

RELATED VIDEOS:

Home Equity Can Secure Your Second Mortgage

Consider the Advantages of Discount Points

FHA Limits are Calculated and Updated Annually

Do you know what's on your credit report?

Learn what your score means.