Learn About FHA Loans and How You Can Qualify

What is an FHA adjustable rate mortgage?

Last modified: July 17, 2023

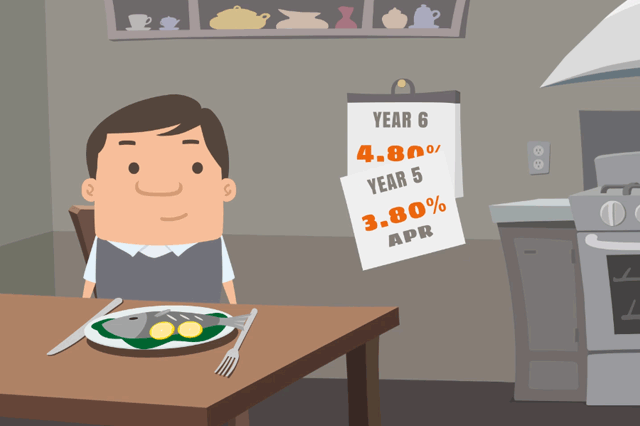

FHA Adjustable Rate Mortgages are also known as ARM loans. They are much different than their fixed rate loan counterparts. With an FHA ARM, you will be offered an introductory or "teaser" rate that will expire on a set date. Once that introductory FHA loan rate has expired, the rate will adjust.

There are rules that limit how much the interest rate may increase or decrease each time, as well as when it may do so, and by how much over the lifetime of the entire loan. FHA loan rules indicate that the maximum rate change to an FHA ARM over the lifetime of the loan is six percentage points, but the actual limit will be dictated by the terms of your loan.

The type of ARM you get will influence how long the introductory rate lasts. It can be one year, three years, five years, etc. The longest introductory rate period you can get, according to the FHA Handbook, is 10 years. Adjustments will generally be one or two points to be imposed annually.