What Credit Agencies Consider a Good Credit Score

While FHA mortgages, such as its purchase loans under the Title II program, the One-Time Close construction loan, or any other type, have more forgiving credit scores, you still need to work on your credit at least 12 months ahead of your home loan application for best results.

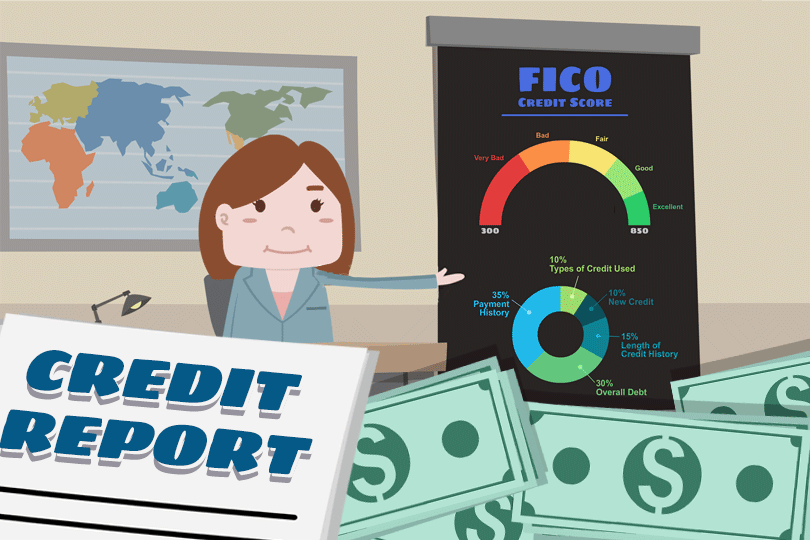

Many finance blogs have varying advice on what to do about your FICO scores if they aren’t in the “good” range.

But what do the credit agencies say is a “good” FICO score? How do the bureaus themselves view your scores?

Experian on “Good” FICO Scores

The Experian official site notes, “To increase your odds of approval and qualify for a lower-rate mortgage, you should aim to have a credit score in the good range. That's a FICO score of 670 or higher.”

While it’s true that on paper, the FICO scores needed for the lowest FHA loan down payment are in the 580-or-better range, lender standards also apply. Many lenders will require a FICO score at 620 or better to qualify for more favorable home loan interest rates and loan terms.

TransUnion on “Good” FICO Scores

The TransUnion official site notes that a “good” credit score “is within the range of 721 – 780.” However, this scoring is based on the VantageScore 3.0® scoring model. If you get a credit score from TransUnion, it is a VantageScore 3.0 credit score.”

VantageScore handles credit data differently than other methods. According to multiple sources, including Credit Karma and Forbes, multiple credit inquiries within a 14-day window are treated as a single credit check, and multiple credit checks above and beyond that 14-day window may have a bigger effect on a VantageScore result.

Equifax on “Good” FICO Scores

Equifax doesn’t add much in the way of commentary. The official site simply notes that a good FICO score is considered between 670 to 739.

Credit scores are an important part of your lender’s decision-making process when offering you an interest rate and loan terms. The better your scores, the more competitive the offer from your lender, assuming all other financials are sound.

FICO scores are not the only deciding factor. Your debts, time on the job, and time in the job market may also factor into the lender’s decision to approve or deny a home loan or to offer more affordable terms.

------------------------------

RELATED VIDEOS:

Know What's On Your Credit Report

FHA Loans Have Credit Requirements

Help Is Available With Down Payment Grants

Do you know what's on your credit report?

Learn what your score means.