How Much Should I Save for a Home Loan Down Payment?

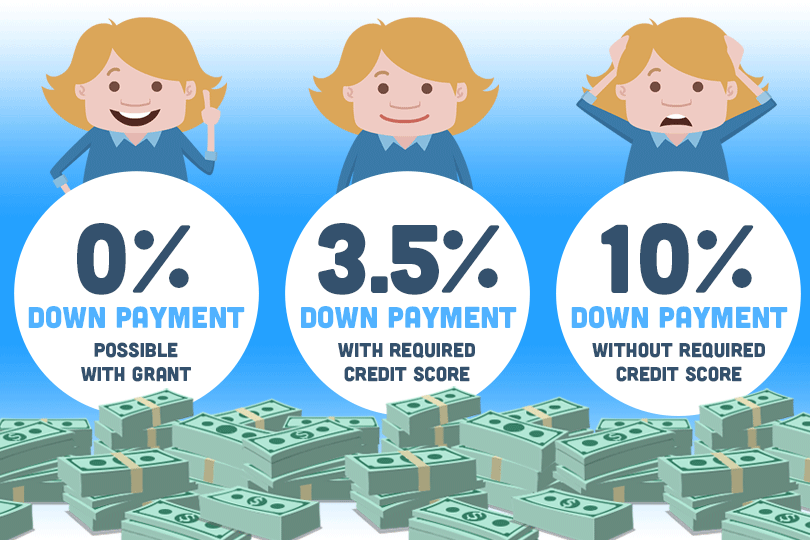

The lowest down payment possible for an FHA mortgage is 3.5% of the price of the home. But how much should you aim for when setting your budget to save up for that down payment?

The short answer is no. But why?

FHA Loan Down Payment Issues

If you buy a home with an FHA mortgage and the home's sale price is $150,000, 3.5% of that amount is $5,250. But that’s not how much you’ll need to pay at closing time. You also need to pay closing costs, which are separate from the down payment but paid for on closing day simultaneously.

Closing Costs

Expect to save up to 6% of the price of the home for your closing costs, including appraisal and any required compliance inspections, lender fees, and other costs. 6% of the $150 thousand amount mentioned above is $9,000.

Naturally, your costs will vary depending on the price of the home. It’s easy to see that the money needed to close comes closer to $14,000 in this scenario.

How long the borrower needs to save that money depends on too many variables to speculate on, but dividing $14,000 by 12 means needing to save approximately $1167 a month for a full year ahead of closing day.

How Long Will it Take?

Some borrowers look at the numbers above and realize they haven’t given themselves enough time to save up that money in the planning stages. Cutting the amount in half and adding an extra 12 months to save it is a smart move to think about making.

In the scenario above, dividing $1,167 in half means saving $583 a month for 24 months to raise both the down payment and the closing costs.

Shortening the Time Needed to Save

Getting help from a down payment assistance program in your area can help shorten the amount of time needed to save for both downpayment and closing costs. So can getting down payment gifts from family or friends.

But don’t forget that your lender needs sourcing information for any down payment help you get, and you’ll need to know that lender’s requirements for documenting the down payment help.

------------------------------

RELATED VIDEOS:

The ARM is an FHA Adjustable Rate Mortgage

A Few Tips About Your Fixed Rate Mortgage

Monthly Payments Establish Good Credit

Do you know what's on your credit report?

Learn what your score means.