Beating High Interest Rates: Re-amortizing a Mortgage

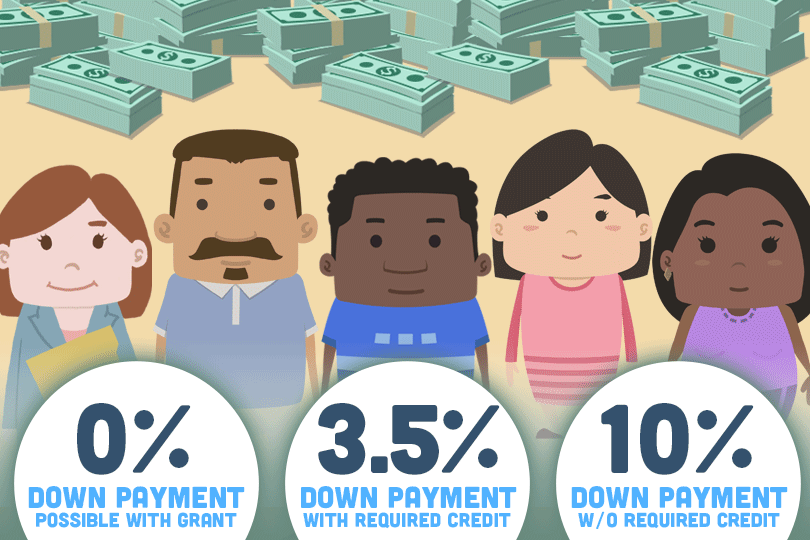

In addition to getting down payment assistance, considering an adjustable rate mortgage, or getting the lender to help you with closing costs, there’s another option.

Paying More Now to Save Later

If you have not signed a contract to commit to buying a house, and you are keen to save money over the duration of the loan term, making the biggest down payment possible is a very good step toward doing so.

The lower your principal balance, the less you will pay on those high interest rates, which is why it’s smart to pay closing costs in cash in addition to making a bigger down payment. Any amount added to the loan will cost you more in today’s higher interest rate environment.

What If You Already Purchased the Home?

Here’s the “meat” of this article. Some borrowers lament that they have already signed the contract, made their down payment, and are committed to the home loan. Are these borrowers stuck paying high mortgage rates on the loan they’ve already started paying on?

Not necessarily. If your lender feels you have enough equity in the home (a minimum number of mortgage payments may be required), you can approach the lender and offer to make a lump sum payment toward the principal balance.

Ask the lender to recalculate the loan based on the remaining time left on the mortgage and the new principal balance.

Is There a Catch? Yes, with Exceptions

Yes. Government-backed mortgages like FHA loans typically do not qualify to have a loan re-amortized. But there ARE FHA loan rules that allow a delinquent loan to be re-amortized.

Consider this March 2023 Final Rule published in the Federal Register about FHA mortgages:

“HUD's regulations allow mortgagees to modify a Federal Housing Administration (FHA) insured mortgage by recasting the total unpaid loan for a term limited to 360 months to cure a borrower's default.”

A new “final rule” published in 2023 rule amends HUD's regulations. The new language lets FHA lenders “recast the total unpaid loan for a new term limit of 480 months,” allowing the borrower to reduce the monthly FHA loan payment “as the outstanding balance would be spread over a longer time frame, providing more borrowers with FHA-insured mortgages the ability to retain their homes after default.”

If you are in danger of becoming delinquent on an FHA mortgage, ask your lender about the option to amortize the mortgage and what conditions are necessary for that to be a realistic option.

------------------------------

RELATED VIDEOS:

Measuring Your Loan-to-Value Ratio

Monitor Your Credit Score

FHA Programs for First-Time Homebuyers

Do you know what's on your credit report?

Learn what your score means.