Loan Approval Issues for FHA Mortgages

Others haven’t checked their credit reports recently and aren’t sure what is in them. What do borrowers need to know about qualifying for an FHA mortgage?

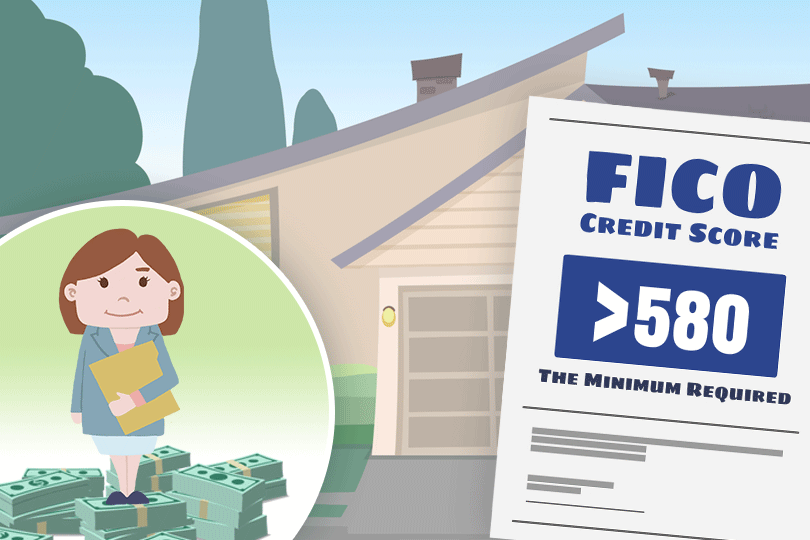

FICO Score Ranges

There’s the FHA FICO score range for qualifying for the lowest down payment, then there are the lender’s standards which may be higher than the FHA’s.

You’ll want to know that your FICO score range meets both standards. And lender standards will vary from bank to bank. Shop around for a lender who can work with your FICO scores.

If your FICO scores are too low to qualify for the lowest down payment but are high enough to be approved with a higher down payment, don’t forget to examine your down payment assistance and homebuyer grant options.

Timing Counts

If you haven’t worked in your current career for 24 months, consider waiting until at least that time has passed. The lender must justify approving your new income for the loan, and more than two years in the same type of work will help greatly.

The Unexpected

You might qualify for a mortgage, and you might qualify for the lowest down payment. But if your home purchase is contingent on selling your existing property, you’ll need to consider how long it will take to sell the home in today’s market.

Selling real estate isn’t a problem in some neighborhoods, but if your housing market is experiencing a slowdown, it may take longer than you realize to sell. Does your purchase agreement include consideration of a slow-selling house?

Don’t forget that your purchase agreement may require you to set a specific date for the sale of your home as part of the contingency clause.

If the terms of your agreement anticipate this, you are in a better position than if you don’t build in some extra time to sell the property in current conditions.

Some FHA Loans Are not Available from Certain Lenders

Sometimes it’s not about whether you can be approved for the FHA mortgage. Instead, it’s about the availability of the loan you want. Borrowers who want to buy existing construction homes don’t typically have a problem finding the right loan product.

But what about those who need an FHA rehabilitation mortgage or an FHA construction loan? These types of mortgages are more specialized. In some markets, there is no demand for the loan, or the loans just aren’t something that the lender wants to offer.

------------------------------

RELATED VIDEOS:

Let's Talk About Home Equity

Understanding Your Loan Term

A Few Words About Bankruptcy

Do you know what's on your credit report?

Learn what your score means.