Why Credit Monitoring Is Important When Planning Your Home Loan

Do you know what your credit report says about you at this moment? If not, you aren’t truly prepared for your home loan application. Those who have not pulled their credit reports should not fill out loan paperwork; there are many issues that can affect your mortgage loan application and they are directly related to the contents of your credit report.

And it’s not enough to pull a single credit report--you should consider what all three of the major credit reporting agencies have in their files in your name. Why do you need to pull reports from Equifax, Experian, and TransUnion? Aren’t the numbers and details published in one report the same as the others?

Not necessarily.

There is a FAQ section for the TransUnion official site that includes answers for companies that wish to report credit information to TransUnion. Here’s an example of one of those questions--in this context, it refers to a company that wishes to submit credit reporting data on a consumer”

The question: “Once a file is transmitted to TransUnion, how long will it take to update a consumer's file?”

The answer is that in general such updates can be reflected in your file as early as 72 hours from submission by the creditor. But that’s not the telling part. Consider this question in the same context--what happens when a creditor sends TransUnion a credit update?

The question: “When a credit data file is transmitted to TransUnion, will the updates be forwarded to the other credit reporting companies?”

The answer from TransUnion? “No. You will need to report the files to each of the credit reporting companies individually if you want each credit reporting company to receive the updates.”

That implies something serious; namely that a creditor may or may not consistently report your credit information to all three credit reporting agencies. The data may be submitted to each agency in a timely manner, to one or more in a delayed fashion, or not at all. You may or may not see the same information in the credit reports you request from all three agencies.

In real life, it’s entirely possible that you will see identical information in each credit report; but until you’ve verified that; you simply can’t assume the reporting information is accurate across all three reports. Remember that the credit reporting agencies work independently of each other. There is no official data sharing and creditors must report to each of the three agencies individually.

------------------------------

RELATED VIDEOS:

Learn How to Meet FHA Requirements

A Few Tips About Your Fixed Rate Mortgage

Your Proof of Ownership Is the Property Title

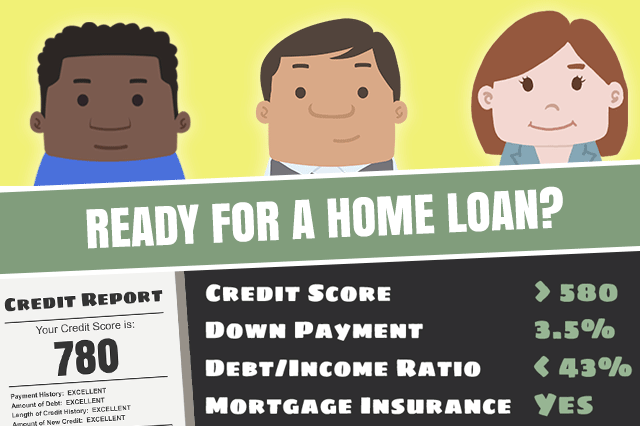

Do you know what's on your credit report?

Learn what your score means.