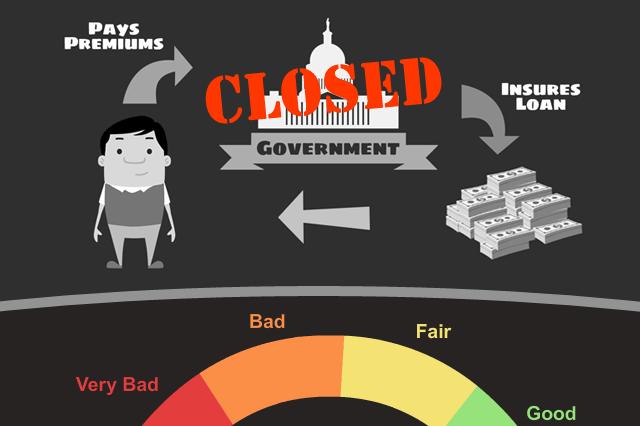

FHA Loans After the Government Shutdown: Did Your Credit Take a Hit?

Of all those affected by the financial issues connected with being furloughed and/or working without pay, a certain percentage is likely (statistically speaking) to have been at some stage of the home loan process whether planning to buy a first home, in the middle of the application process as a first-time home buyer, or as a return customer.

And of that number, how many took a credit score hit due to these financial issues?

If you are worried about FHA home loan approval due to financial issues caused by the government shutdown, you should know that your participating lender is permitted under FHA guidelines to take into account the temporary and beyond-the-borrower’s-control nature of the shutdown and any resulting damage to the applicant’s credit report.

The borrower is usually required in these cases to provide documentation that the financial hardship was a unique issue, beyond the borrower’s ability to control, and that since the hardship has ended that a pattern of reliable payments and responsible credit use has resumed.

Lender standards may vary, so what follows should be taken as a good starting point but you will need to check with the lender to see what may be required by your financial institution in addition to meeting FHA loan requirements.

If you are concerned about your credit in the wake of the government shutdown, it’s a good idea to assemble any documentation you can provide that will demonstrate that you were furloughed, worked without pay, or were otherwise unable to collect your paycheck during the shutdown period.

Print out any email, regular mail, or similar correspondence that can show your lender that you were affected by the shutdown. You may also need to show documentation of any new credit or use of existing credit required to make ends meet in the absence of your paycheck during the affected periods. It’s important to remember that even a first-time home buyer can request added consideration for such extenuating circumstances.

Don’t assume that an FHA home loan is unavailable to you because you weren’t able to meet your financial obligations over the shutdown-your lender may be able to take such temporary setbacks into account when determining your creditworthiness.

------------------------------

RELATED VIDEOS:

Homebuyers Benefit From the Work Done by Fannie Mae

HUD 4000.1 is Sometimes Called the FHA Handbook

Credit History Is Presented as Your FICO Score

Do you know what's on your credit report?

Learn what your score means.